r&d tax credit calculation example

Companies that use tax incentives such as the RD tax credit and. On March 22 a coalition of business groups including the US.

SSTB using an S corporation under the threshold amount.

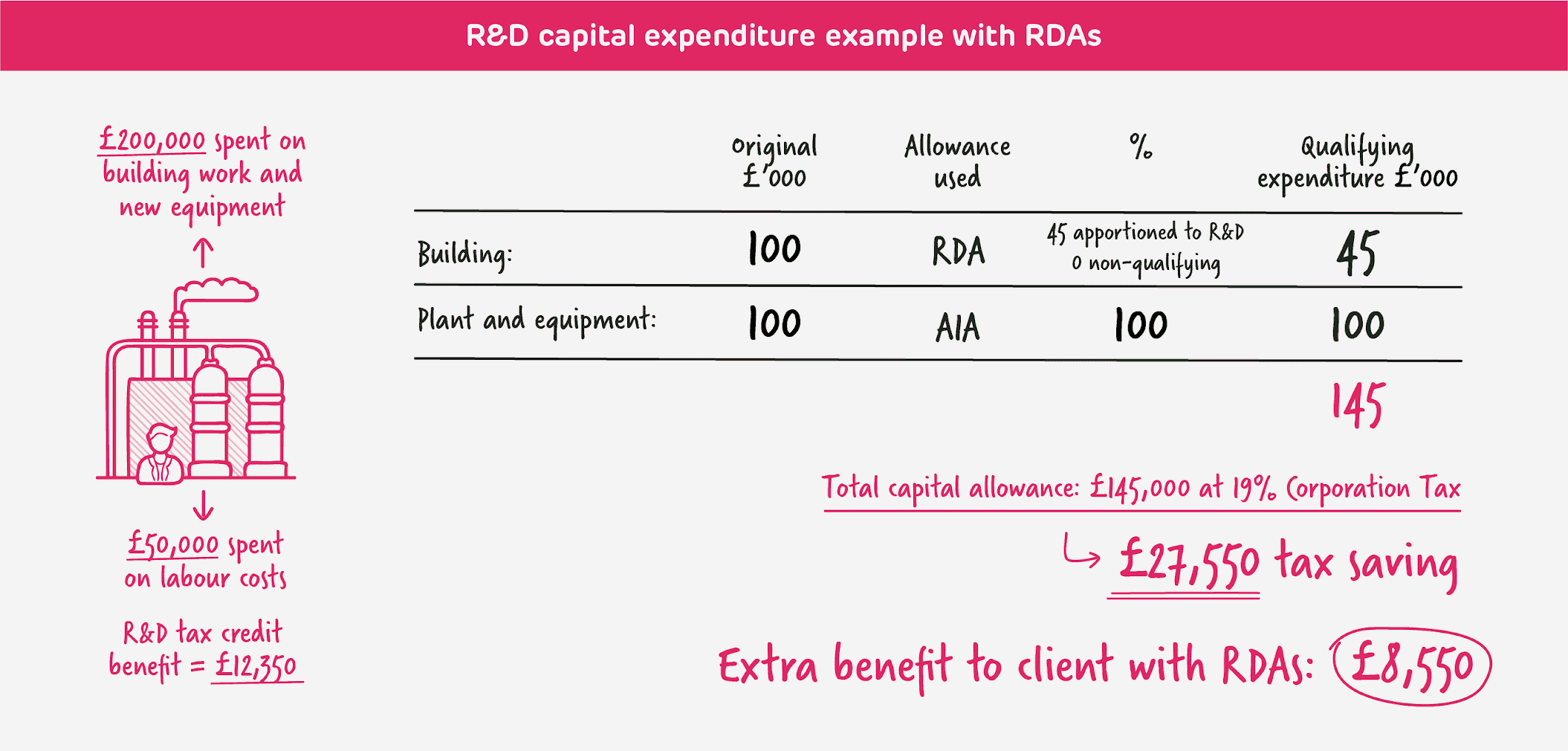

. Conversely if an amount would have been included in your assessable income under the standard balancing adjustment provision of section 40-285 the sum of that amount the section 40-285 amount plus an additional amount is included in your assessable income. The treatment of all gain recognized under the installment method for BIG tax purposes is governed by the BIG tax provisions in effect for the year of sale. That notional RD deduction is included in the calculation of your RD tax offset.

Companies defined as established firms are firms with gross receipts and QREs in at least three of the tax years from 1984 to 1988. The RD tax credit is an example of a carryforward credit. Your RD tax credit is not taxable income.

On Finance 98th Cong 2d Sess Deficit Reduction Act of 1984 Explanation of Provisions Approved by the Committee on March 21. By logging payment dates notes regarding those payments and any questions you may have at that moment in time youll ease the process and make taxes more manageable for everyone. For example software companies that invest in their technology.

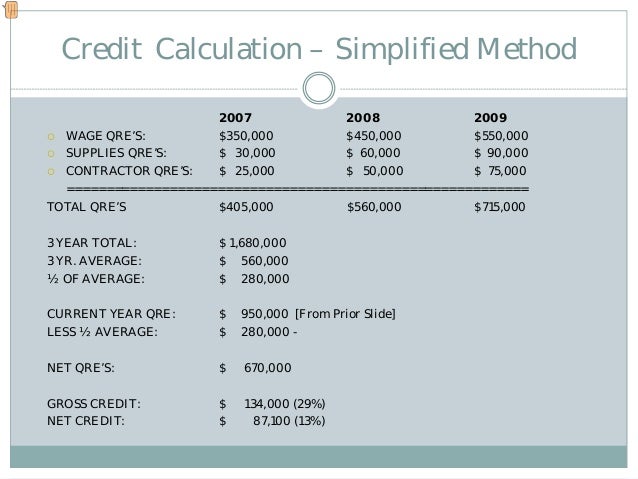

This estimated quarterly tax payment calculator isnt just for conveying information with your tax expert but also for communicating with your future self. Amortised over 5 years 20k would be charged to the income statement each year. This base-amount calculation process represents an attempt to measure the firms historical level of RD expenses and then adjust it to account for the firms current revenue situation.

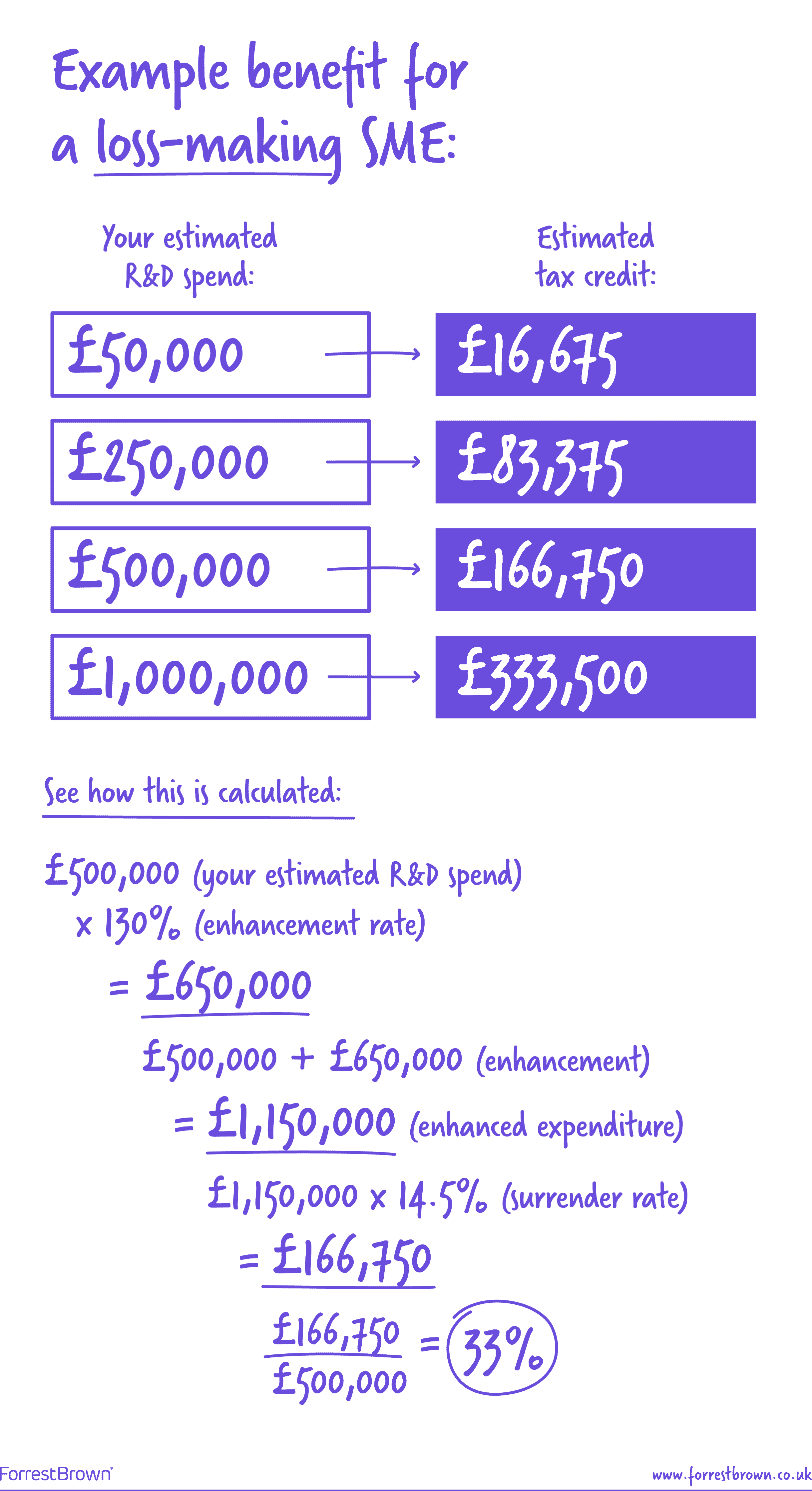

RD Tax Credit Calculation. An SME may claim a payable RD tax credit for an accounting period in which it has a surrenderable loss. Since these taxpayers are under the threshold amount the only.

100k of qualifying RD expenditure is spent by a business on developing a software platform. Irish Department of Finance seeks public comments by May 30 on research development RD tax credit and the Knowledge Development Box an OECD-compliant intellectual property regime which provides relief from corporation tax on income arising from qualifying assets such as computer programs and inventions protected by a qualifying. A married couple filing jointly have 300000 of taxable income and a business that is an SSTB with 225000 of QBI before considering 125000 of W-2 wages paid to the shareholderemployee.

Before you can calculate the amount you receive in RD tax credit carryforward youll need to ensure that your business is located in the US and pays tax. Will often be too low. How far back can you claim RD tax credits.

Accounting treatment for SME RD tax credit scheme. 1 2008 or earlier all gains under a 2013 installment sale escape the BIG tax even if the 10-year recognition period springs into. 21 For example if the S election was effective on Jan.

Treasury Secretary Janet Yellen expressing concern that the OECDs model rules could target US. This is allowable for tax purposes and would generate an RD tax credit up to 33 of each years deductible costs 66k in each year. For the other corporations the Saskatchewan RD tax credit remains a non-refundable tax credit at the rate of 10 on eligible expenditures incurred after March 31 2015.

Treasury Stock Method Calculation of Diluted Shares. Chamber of Commerce the Silicon Valley Tax Directors Group and the Business Roundtable penned a letter to US. By reducing the cost of RD activities to firms tax credit proponents argue that government can encourage greater investment in RD.

Before April 1 2015 and after March 31 2012 the Saskatchewan tax credit was refundable for CCPCs subject to a 3 million expenditure limit and non-refundable in all other. It also refers to the spreading out. Amortization is the paying off of debt with a fixed repayment schedule in regular installments over a period of time for example with a mortgage or a car loan.

The regular RD credit equals 20 percent of a firms QREs above a certain baseline level. For instance lets say that a company has 100000 common shares outstanding and 200000 in net income in the last twelve months. Generally businesses can claim RD tax credits for tax returns with an open statute of limitations which typically includes the prior three years.

Due to it being simple to understand it is often called an alternative simplified credit. 67-275 at 17 1921 describing the need to avoid Start Printed Page 285 allowing a foreign tax credit to wipe out tax properly attributable to US. We can then subtract the 5000 shares repurchased from the 10000 new securities created to arrive at 5000 shares as the net dilution ie the number of new shares post-repurchase.

For SMEs claiming RD tax credits the accounting treatment is straightforward. The claim must be. It is a below-the-line benefit and will be shown in your income statement also known as your profit-and-loss account either as a Corporation Tax reduction or a credit.

See for example S.

R D Tax Credit Calculation Methods Adp

R D Tax Credit Calculation Methods Adp

Sol Transparent Metodologie R D Tax Calculator Specialeventbuilder Com

R D Tax Credit Rates For Rdec Scheme Forrestbrown

Rdec Scheme R D Expenditure Credit Explained

R D Tax Credit Calculation Examples Mpa

R D Tax Credits Calculation Examples G2 Innovation

R D Tax Credit Calculation Examples Mpa

R D Tax Credit Rates For Rdec Scheme Forrestbrown

The R D Tax Credit Aspects Of Saas Start Ups R D Tax Savers

R D Tax Credit Rates For Sme Scheme Forrestbrown

How Do Phaseouts Of Tax Provisions Affect Taxpayers Tax Policy Center

State R D Tax Credits Are You Missing Out Wipfli

R D Tax Credit Calculation Examples Mpa